Exactly How a Secured Credit Card Singapore Can Assist You Reconstruct Your Credit Report

Exactly How a Secured Credit Card Singapore Can Assist You Reconstruct Your Credit Report

Blog Article

Unveiling the Opportunity: Can Individuals Released From Bankruptcy Acquire Credit Report Cards?

Recognizing the Impact of Bankruptcy

Upon declaring for insolvency, people are faced with the considerable effects that penetrate different aspects of their economic lives. Personal bankruptcy can have an extensive influence on one's credit history rating, making it challenging to gain access to credit report or car loans in the future. This financial tarnish can remain on credit scores reports for a number of years, impacting the person's capability to safeguard beneficial rates of interest or monetary chances. In addition, bankruptcy may lead to the loss of assets, as particular ownerships might require to be liquidated to repay creditors. The psychological toll of insolvency ought to not be taken too lightly, as people might experience sensations of regret, tension, and embarassment as a result of their monetary circumstance.

In addition, bankruptcy can restrict work chances, as some companies perform credit score checks as component of the working with process. This can present a barrier to individuals looking for new task potential customers or job advancements. Overall, the influence of insolvency extends past monetary restraints, affecting various aspects of an individual's life.

Elements Impacting Bank Card Approval

Acquiring a charge card post-bankruptcy rests upon various key elements that considerably affect the authorization procedure. One vital variable is the applicant's credit rating. Following insolvency, individuals often have a low credit history as a result of the unfavorable impact of the bankruptcy filing. Credit score card firms commonly look for a debt score that demonstrates the candidate's capability to manage credit scores responsibly. One more crucial factor to consider is the candidate's earnings. A stable income guarantees credit card issuers of the individual's capability to make timely repayments. In addition, the length of time since the bankruptcy discharge plays a crucial role. The longer the duration post-discharge, the more beneficial the chances of approval, as it suggests monetary security and responsible credit history habits post-bankruptcy. In addition, the sort of charge card being made an application for and the provider's details demands can also influence authorization. By meticulously considering these aspects and taking steps to reconstruct debt post-bankruptcy, individuals can enhance their potential customers of getting a bank card and working towards financial recuperation.

Steps to Rebuild Credit Score After Personal Bankruptcy

Reconstructing credit history after personal bankruptcy requires a tactical method focused on financial self-control and constant financial debt management. One efficient method is to acquire a protected debt card, where you deposit a particular quantity as collateral to develop a debt restriction. Additionally, think about becoming an accredited customer on a family members participant's debt card or exploring credit-builder fundings to further enhance your credit history score.

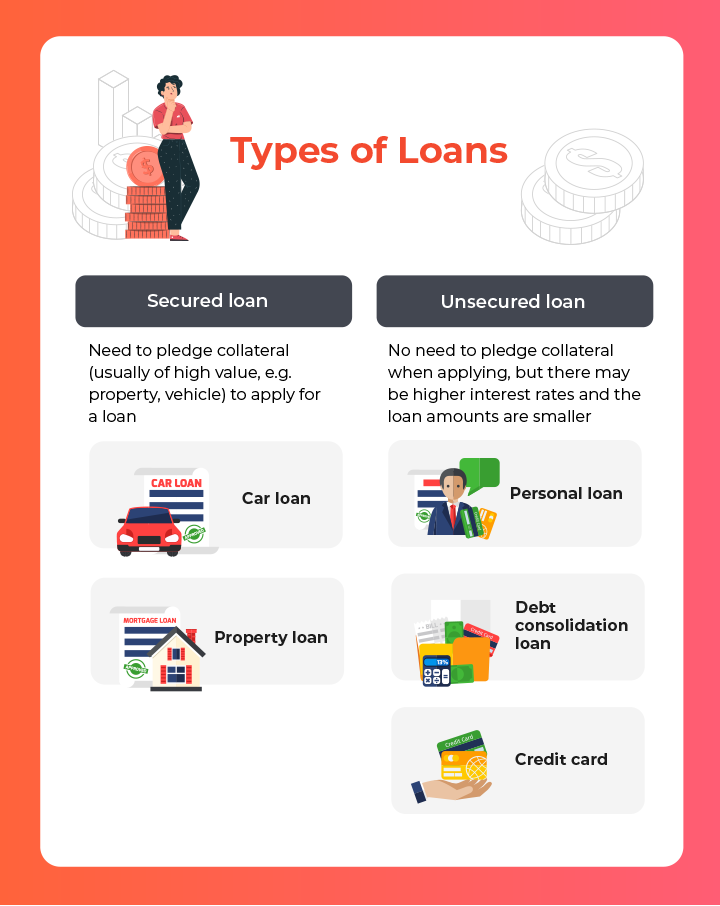

Secured Vs. Unsecured Credit Score Cards

Complying with insolvency, people commonly consider the option between protected site web and unprotected charge card as they aim to rebuild their creditworthiness and financial security. Secured charge card call for a money deposit that works as security, usually equal to the credit line approved. These cards are simpler to get post-bankruptcy because the down payment reduces the danger for the company. Nevertheless, they may have higher fees and rates of interest contrasted to unsecured cards. On the various other hand, unsecured bank card do not require a deposit but are more challenging to get after bankruptcy. Providers examine the applicant's creditworthiness over at this website and may offer lower fees and rates of interest for those with an excellent financial standing. When deciding between both, people ought to evaluate the advantages of easier approval with protected cards versus the potential prices, and think about unsafe cards for their lasting financial goals, as they can aid restore credit without locking up funds in a down payment. Ultimately, the option between safeguarded and unsafe bank card need to align with the individual's monetary goals and capability to take care of credit rating properly.

Resources for People Looking For Credit History Restoring

For people intending to enhance their credit reliability post-bankruptcy, checking out available resources is important to effectively navigating the credit report restoring process. secured credit card singapore. One useful resource for individuals seeking credit restoring is credit report counseling agencies. These organizations offer financial education, budgeting aid, and individualized credit scores enhancement strategies. By collaborating with a credit rating counselor, individuals can obtain understandings into their credit report records, find out techniques to improve their credit report, and receive guidance on handling their finances successfully.

One more practical source is credit score tracking services. These services enable people to keep a close eye on their debt reports, track any kind of mistakes or adjustments, and discover potential indications of identity theft. By monitoring their credit rating on a regular basis, individuals can proactively resolve any problems that may ensure and emerge that their credit details is up to date and accurate.

Moreover, online devices and sources such as credit rating simulators, budgeting applications, and economic proficiency websites can provide people with useful info and tools to aid them in their credit scores rebuilding trip. secured credit card singapore. By leveraging these resources properly, people discharged from bankruptcy can take purposeful actions in the direction of boosting their credit scores health and securing a far better economic future

Final Thought

In final thought, people released from personal bankruptcy may have the possibility to acquire credit scores cards by taking steps to rebuild their credit score. Factors such as credit scores background, debt-to-income, and revenue ratio play a considerable duty in credit report card authorization. By understanding the impact of bankruptcy, choosing between secured and unsafe bank card, and using resources for credit report restoring, individuals can improve their credit reliability and possibly acquire access to charge card.

By functioning with a debt therapist, people can acquire insights into their credit score reports, find out methods to increase their credit ratings, and get guidance on handling their funds successfully. - secured credit card singapore

Report this page